Credit card convenience and the desire to capture more credit card rewards are resulting in increased credit card usage among consumers. More consumers are now utilizing their credit cards to pay for services such as utility bills rather than writing checks or paying through online banking or biller direct.

While this trend is convenient for consumers, it is resulting in increased payment processing costs for businesses. In some cases, the cost to process a customer payment jumped from 0.01 percent to over 3.00 percent of the payment value, causing a significant negative margin impact.

In an effort to make up for the rewards and payment rebates provided to consumers, credit cards charge a higher interchange fee to the seller. PayStream believes that if nothing is done to change this current credit card trend, interchange fees may be expected to increase from 1 percent of total dollars collect in 2013 to over 1.25 percent of total dollars per year by 2015.

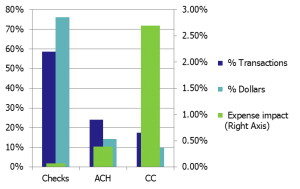

When payment channels are grouped by payment method, the cost of processing credit cards stands out. Payment channel affects cost, but payment method is the major factor driving costs higher, see Figure 1.

Figure 1

Credit Cards (CC) account the highest payment processing cost.

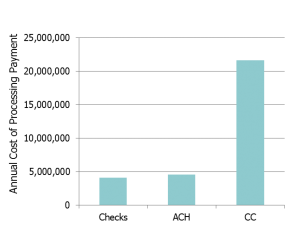

Even though credit card payments only account for around 10 percent of annual cash collected, the total dollars to process card payments exceeds the cost of processing checks and electronic payments combined, see Figure 2.

Figure 2

Total dollars to process credit card (CC) payments exceeds the cost of processing checks and ePayments.

Growth in credit card payments is cannibalizing payments from check and ACH payment methods and increasing the cost for billers to process payments from consumers. In an effort to educate billers on reining in credit card processing costs and interchange fees, PayStream is currently preparing a Q2 2013 report on Electronic Billing and Remittance Payments. This report will provide insights into current and emerging consumer payment trends, and will also feature profiles of leading providers in the space who have strong capabilities and product strategies to meet the needs of organizations remittance payment management efforts.

This upcoming Q2 report will work to increase corporate and collection mangers’ ability to distinguish between Electronic Billing and Remittance Payments and payment automation solution providers and the various solutions they offer. The report will provide answers and insight into today’s changing payment landscape and how companies can benefit from these changes.