The Voice of P2P Automation from the Finance Process Gurus at PayStream Advisors.

T&E Expense Management Automation Gets a Boost from the Recession and the Resulting Need for Cost Containment

Posted On December 1, 2009 by PayStream Advisors

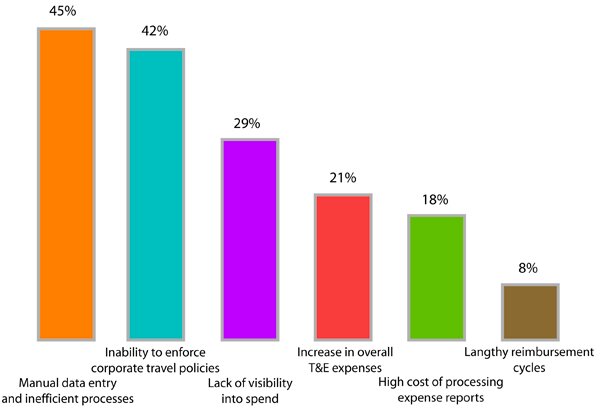

Technological advances have shrunk our world into a single, global marketplace. Tools like the Internet, email, video conferencing etc. have made it easy for organizations to connect with their customers and suppliers, whether they are across the street or across the ocean. However, these same factors that are responsible for expanding a company’s geographic footprint have resulted in an increase in international travel and the costs associated with this. Over the last few years, increase in the amount of business travel combined with escalating travel costs have significantly increased spending on corporate travel and entertainment expenses, making the second largest cost pool for most organizations, just behind salaries and benefits. However, with the economy in a recession, companies are taking a hard look at these costs and investigating ways to control them. It is no surprise therefore that more than a third of the companies (38 percent) that participated in PayStream’s “T&E Expense Management Adoption” survey stated that they have decreased their T&E spend over the last three years. Manual T&E Processes are Fraught with Challenges There are complexities inherent to managing any paper-based process and the survey revealed that travel & expense is no exception. The biggest challenge for almost half the organizations (45 percent) was manual data entry and inefficient processes. More than a third of the respondents (35 percent) mentioned that lack of visibility into spend was a problem they faced. An equal number found inability to enforce corporate travel policies to be a challenge. High cost of processing expense reports was a challenge for a little less than a quarter of the organizations surveyed. Challenges With Manual T&E Processes  Time is Ripe for Automation Our research reveals that, owing to the emphasis on decreasing travel-related spend and the existing challenges faced in the travel management process, organizations are actively seeking automation options to help them streamline the expense management process and reduce its associated costs. Analyzing Processing Costs Based on survey results, the average cost to process a single expense report, across all companies surveyed, was $14.63. What was interesting to note was the relation between processing costs and the extent of automation an organization had in place. It is obvious from Table 1 that automation drives down processing costs. On average, a company spent approximately $28.21 to process an expense report if the process was entirely manual. This was four times as much as the processing costs accrued by companies that have automation in place. Organizations that have some automation in place have been successful in driving down processing costs per transaction to $7.42, whereas companies that are fully automated and using an integrated system have costs a per transaction cost as low as $6.19. The direct relation between lower processing costs and automation also bodes well for companies that are shying away from automation because they believe that current processes work or that there is no ROI to be achieved from automation. This should make such companies take a second look at the range of options available in the T&E automation space today. PayStream T&E Expense Management Adoption Survey Report PayStream Advisors conducted its “T&E Expense Management Adoption Survey” in the third quarter of 2009 and developed a benchmarking report to highlight the overall trends that are shaping this rapidly evolving space. The complimentary report can be downloaded here. This survey report is designed to:

Time is Ripe for Automation Our research reveals that, owing to the emphasis on decreasing travel-related spend and the existing challenges faced in the travel management process, organizations are actively seeking automation options to help them streamline the expense management process and reduce its associated costs. Analyzing Processing Costs Based on survey results, the average cost to process a single expense report, across all companies surveyed, was $14.63. What was interesting to note was the relation between processing costs and the extent of automation an organization had in place. It is obvious from Table 1 that automation drives down processing costs. On average, a company spent approximately $28.21 to process an expense report if the process was entirely manual. This was four times as much as the processing costs accrued by companies that have automation in place. Organizations that have some automation in place have been successful in driving down processing costs per transaction to $7.42, whereas companies that are fully automated and using an integrated system have costs a per transaction cost as low as $6.19. The direct relation between lower processing costs and automation also bodes well for companies that are shying away from automation because they believe that current processes work or that there is no ROI to be achieved from automation. This should make such companies take a second look at the range of options available in the T&E automation space today. PayStream T&E Expense Management Adoption Survey Report PayStream Advisors conducted its “T&E Expense Management Adoption Survey” in the third quarter of 2009 and developed a benchmarking report to highlight the overall trends that are shaping this rapidly evolving space. The complimentary report can be downloaded here. This survey report is designed to:

- Help accounting and finance practitioners familiarize themselves with the TEM landscape,

- Enable them to better understand the extent of adoption of the various forms of TEM automation, and

- Allow companies to benchmark their operations against similar businesses.

Comments

Be the first to comment on this post

Posted In Purchase to Payment Tags:

Subscribe to PayStream

Subscribe to PayStream

Voices by Email

Subscribe in a reader

Subscribe in a reader

Tweets by @PayStream

Discussion Topics

- Accounts Receivable

- B2B Credit and Collections

- C2B Payment & Collections

- Consumer Finance

- Order to Cash

- PayStream Health

- Press Releases

- Purchase to Payment

- Uncategorized

Recent Posts

Copyright © 2013 PayStream Advisors, Inc.

Research. Analysis. Strategy. ®

Research. Analysis. Strategy. ®